a excellent strategy for those looking to unwind and cognizance on different matters this summer season.

the approach writer offers to change such currency pairs as eur/usd, gbp/usd, aud/usd, nzd/usd, usd/jpy, usd/chf, and usd/cad on any timeframe from М1 to mn, despite the fact that i in my view see no obstacles to use it with any other tool not only on forex, however additionally stock and futures markets. apparently, the author handiest trades foremost foreign money pairs, so he decided now not to advise some other monetary instruments.

the “travel buying and selling profit formula” method computer

the method desktop:

the parabolic sar indicator with: acceleration element (af) = zero.02, most acceleration (ma) 0.2

the transferring average indicator with: period = 20, shift = 0, МА approach = simple, practice to = near

the macd indicator with: rapid ЕМА = 12, gradual ЕМА = 26, macd sma = 9, observe to = near

the force index indicator with: duration = thirteen, МА technique = easy, follow to = close

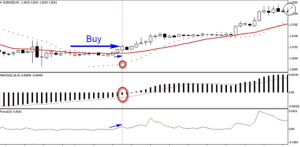

a sign to buy underneath the “tour trading earnings method” approach

the subsequent conditions need to be met in order for a signal to shop for to seem on the chart:

in step with the method, the parabolic sar indicator should be under the fee chart

the transferring common indicator ought to additionally be below the fee chart, directed upwards

the macd indicator sign line must be under 0, outdoor the histogram place

the force index indicator have to be moving upwards

the candlestick, in which some of these situations are met, have to be absolutely formed. best after that, one would possibly open a protracted function

an example of a sign to shop for beneath the “travel trading income components” method

the method writer places unique emphasis on the truth that all five conditions should be met earlier than a dealer opens a long role.

a sign to sell underneath the “travel buying and selling profit components” approach

the following conditions should be met so as for a sign to sell to appear at the chart:

the parabolic sar indicator ought to be above the charge chart

the transferring average indicator need to also be above the fee chart, directed downwards

in step with the approach, the macd indicator signal line need to be above 0, out of doors the histogram region

the pressure index indicator need to be moving downwards

the candlestick, wherein most of these situations are met, ought to be completely formed. most effective after that, one may open a quick function

an example of a sign to sell below the “tour buying and selling earnings system” method

a signal appeared for the duration of the primary hour of buying and selling week. even though it appeared on a bullish candlestick instead of a bearish one, one would possibly earn properly money.

forestall loss and take income inside the “tour buying and selling income formula” strategy

the approach author recommends putting the forestall loss order 15-20 factors (150-200 pips with five digits or 3 digits for usdjpy) away from the access factor, however i strongly disagree with him, due to the fact this recommendation is a chunk disconnected from reality.

of course, this approach would possibly paintings for minute timeframes, but on the subject of longer intervals, the recommendation may wreck the complete trading method. i agree with the forestall loss order should be located in step with the safe, proven, and, most significantly, affordable approach: below the preceding local low whilst selling and above the previous local excessive when shopping for. and don’t overlook about spread when beginning brief positions.

the buying and selling method doesn’t require a trader to hold a function. but, i suppose it received’t get tons worse in case you use new neighborhood extremums to mitigate risks and guard income. but, each dealer must take a look at for themselves whether or not it is powerful for them.

on the equal time, the strategy doesn’t imply take income orders. however, if you backtest it and discover that buying and selling is probably greater effective with take profit orders, i see no motives why you shouldn’t add them to the strategy.

a trader can near a position opened below this trading system if the shifting common rose after promoting or fell after shopping for. however, simplest if the “parabolic sar” indicator and the “macd” indicator sign line are above the chart and zero respectively in the case of promoting, and beneath the chart and zero in the case of buying.

however, a signal to close a function has the following peculiarity: in case you close a position in line with those situations, when buying and selling beneath this method, you gained’t be capable of benefit from any most important fashion motion. so, if a function is already “inside the black” and there’s a signal to close, i would advocate to move the forestall loss order under the preceding local low and above the previous nearby high within the case of buying and promoting respectively.

if the today’s extremum is within the institution of extremums, use the bottom extremum of all local lows and the highest extremum of all nearby highs to vicinity a protecting forestall order. and if a role is “in the crimson” after a likely activation of a relocated prevent loss order, it’d be wise simply to close it. it’d be better to have a ignored possibility rather than dropping money.

money management underneath the “travel trading earnings system” approach

if you alternate with a specific lot size, the difference inside the risks in every role might have a tremendous impact on buying and selling results, regardless of what percentage of orders have been a hit or with what ratio a trader managed to go into worthwhile positions.

that’s why, i’d advise a selected lot length for each order, which would suggest the threat because the equal percentage of the present day deposit for every order. at the beginning, you shouldn’t definitely exceed 1% of the deposit. later, you could boom it, but not extra than 2%. but, if you plan to hazard extra, spend some greater time gaining knowledge of and trying out the method so that you can increase the hazard percent for each position, but no longer more regularly than as soon as a month.

by using the way, although the full range of situations for coming into the market is instead small, i’d advise to put in writing them down and preserve it close at hand. for the reason that strategy calls for you to behave rapid when a signal appears, you could omit one of the conditions in a rush and it could lead to unsystematic entries with a purpose to have a bad have an impact on on buying and selling consequences.

it frequently occurs which you neglect some requirement for a buying and selling signal. to avoid this, use stickers with all access conditions and necessities for every sample somewhere to your desk or desktop in which you can see them regularly.

an example of trading below the “tour buying and selling earnings method” approach

it should be right now referred to that such a hit and “clean” orders do no longer often appear in this method. the longer the time frame, the less regularly they occur. however, it doesn’t imply that a trader must switch from the timeframes they got used to a shorter one. it’s better to stick with a snug duration and growth the dangers a little bit than vice versa. i individually arrived at this end, however you don’t need to keep by using what it says.

All About News Trusted news and information

All About News Trusted news and information