ethereum, additionally usually known as ether, is the arena’s 2d biggest cryptocurrency at the back of bitcoin, and like any virtual foreign money, it has skilled its honest percentage of americaand downs over its particularly quick lifetime.

the rate of ethereum rose to a document $us4800 in past due 2021, which signified a upward push of extra than 900% over the preceding 12 months and sparked hypothesis that ether might overtake bitcoin in cost.

however, ether changed into no longer immune from the crypto routing of may additionally 2022 and tumbled in fee along many different cryptocurrencies. ether is now buying and selling at $us1423 (as of july).

what are cryptocurrencies?

inside the truest sense, cryptocurrencies are a virtual manner of alternate which use cryptography as a shape of protection. however, in more recent instances, the term ‘cryptocurrency’ has developed to embody a decentralised monetary gadget (defi), a surprisingly risky asset elegance which could nostril-dive or surge at the returned of a tweet, a space for awful actors to steal inclined investors’ identities and money, a mode of asset diversification, and a shape of digital payment.

ethereum once had an powerful marketplace capitalisation of round $250 billion, however, has these days lost extra than $100 billion in price due to the crypto slide of may additionally 2022 and is now sitting at around $a hundred thirty five billion in market cap.

if you’re acquainted with bitcoin but less au fait with its closest rival, right here’s what you need to understand approximately ethereum consisting of why, sooner or later, it may still grow to be the dominant participant at the cryptocurrency degree.

first, a crypto wealth caution

you don’t want to follow the monetary international that carefully to understand that cryptocurrencies have turn out to be one in every of its biggest tales in recent years.

nowadays, they pre-occupy the mind of governments and predominant monetary institutions alike and divide opinion as to whether or not they’re basically ponzi schemes that want to be severely regulated, or are virtually risky asset instructions for traders who enjoy a excessive-stakes gamble.

if your monetary plans revolve around capital upkeep – putting onto what you’ve were given – then the risky behaviour of cryptocurrencies is maximum honestly now not for you.

last month, jerome powell, the chairman of the united states federal reserve, described cryptoassets as no higher than “automobiles for speculation”. and at its can also agm, the legendary berkshire hathaway vice-chairman and investor, charlie munger, stated bitcoin turned into “disgusting and contrary to the interests of civilisation”.

comments including those, however, fail to put off thousands and thousands of aficionados around the arena from looking to make money from cryptocurrencies, such as bitcoin. this consists of australians, who’re increasingly more getting in at the act: current roy morgan studies has found out that five%, or extra than one million adult australians own at the least one cryptocurrency.

if that consists of you, laith khalaf, uk financial analyst at brokers aj bell, gives some easy steering: “those who desire to benefit publicity to cryptocurrencies ought to only achieve this with a small amount of cash that they are inclined to lose,” he suggests.

it’s worth adding that crypto-asset investing is unregulated in australia, as well as in maximum european countries and in the united kingdom, and there’s no patron safety ought to things move incorrect.

which brings us returned to ethereum.

what is ethereum?

in line with on line agents etoro, ethereum is particular in the cryptocurrency universe.

ethereum, released in 2015, embraces an open-source software platform that builders can use to create cryptocurrencies and different virtual applications.

ethereum’s native cryptocurrency is called ether (trading ticker is eth), at the same time as ethereum in reality refers to a particular blockchain generation, the decentralised allotted digital ledger that continues track of all transactions. ledgers are the rules of cryptocurrency transactions.

think of ether as the cryptocurrency token derived from the ethereum blockchain. a blockchain permits encrypted records to be transferred securely, making it nearly impossible to counterfeit. as with bitcoin, those tokens are presently “mined” thru computers fixing mathematical issues.

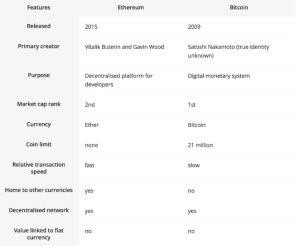

bitcoin uses blockchain generation as well (see above for the variations between the 2 cryptocurrencies), but ethereum is appeared as extra state-of-the-art and can be used to run programs. it’s this thing, some commentators say, which could at some point help it to shunt bitcoin from the pinnacle cryptocurrency spot.

in recent times, ethereum’s reputation has grown amongst both retail and institutional traders alike.

what are the blessings of buying into ethereum?

in keeping with etoro, ethereum may be without problems traded or exchanged for other cryptocurrencies.

in addition, the broking says the cryptocurrency may be used at a growing variety of online and bricks-and-mortar retailers. transaction instances are faster while compared to the ones for bitcoin and it additionally offers access to a number of decentralised programs (dapps) allowing developers to create new on-line tools.

progress inside the retail bills sphere became emphasized in march 2021 while british-based totally christie’s have become the first auction residence of its kind to simply accept ether as charge for a piece of artwork with the aid of beeple. called ‘everydays: the first 5000 days’, the acquisition fee equated to a figure of $us69.three million.

at the cease of april 2021 and confirming the financial quarter’s growing interest in the cryptocurrency sphere, the ecu investment financial institution issued its first ever €one hundred million two-yr virtual bond via the ethereum blockchain.

in the meantime, at the beginning of may, the s&p dow jones released numerous cryptocurrency indexes, inclusive of one for ethereum, aimed toward measuring the performance of virtual property.

how do you buy ethereum in australia?

this could be finished thru a crypto trade inclusive of coinbase or thru on-line platforms inclusive of gemini, kraken or etoro. you can additionally choose from more than a few australian-based exchanges, including coinspot and btcmarkets, which allow users to buy cryptocurrencies with aud, which includes thru bank transfers, in a few times, or thru bpay.

you create an account with the selected provider confirming your region of house and identity after which hyperlink to your financial institution account in order to shop for the forex. costs will vary from one company to some other and might rely upon the quantity you want to deposit, (in the end) withdraw and for the transactions you need to carry out.

payment techniques can include those via debit/credit playing cards to paypal and wire transfers. new traders may additionally need more degrees of customer help in comparison with pro buyers.

should ethereum’s fee upward push again?

inside the world of cryptocurrencies, few things can be taken with no consideration, and there aren’t any certainties. and as we’ve said above, there are lots of senior figures inside the economic network who hold deep reservations approximately the safety, perhaps even the viability, of the general concept of crypto.

however nigel green, leader executive and founding father of the global devere institution financial consultancy, has formerly recommended ethereum is the crypto to look at: “ether may be anticipated to significantly dent bitcoin’s marketplace dominance over the next yr and beyond. compared to its larger rival, ethereum is more scalable, offers more makes use of and solutions, such as clever contracts which might be already used throughout many sectors, and is sponsored with superior blockchain technology,” he delivered.

aj bell’s laith khalaf acknowledges ether’s relative strengths inside the cryptocurrency context, but he advocates extreme warning: “ether, or ethereum, is extra bendy than bitcoin due to the fact it is programmable in keeping with use, so it can be used to affirm commercial enterprise transactions or contracts as well as make payments.

“however, the cost of that asset is still simplest what a person else pays for it, and even as that is probably pretty plenty right now, as soon as crypto fever has died down, it may no longer be well worth the code it’s written in.”

All About News Trusted news and information

All About News Trusted news and information